Claim Denial 101: Top Reasons You’re Getting Denied and How to Turn It Around

Understand why claim denials happen in healthcare and what to make of the denial codes communicated by payers. Also, explore how AI-powered denial management can help get faster reimbursements and avoid denials altogether.

August 12, 2025

.webp)

Key Takeaways:

• Claim denials aren’t just billing errors; they’re lost revenue and operational bottlenecks.

• Most denials are preventable, including issues like eligibility errors, missing authorizations, incomplete or inaccurate documentation.

• Payers use standardized documents (ERAs/EOBs) to explain denials, and decoding them is key to fixing root causes.

• Manual denial management is slow and expensive. AI can automate denial categorization (by payer, provider, etc), spot denial trends early, prioritize high-value denials, and work to resolve them.

• Tracking denial metrics by provider, payer, department, and service type helps healthcare leaders turn denial insights into real revenue opportunities.

Let’s face it: Claim denials are one of the most frustrating (and expensive) problems in healthcare revenue cycles.

When denials pile up, besides hurting your bottom line, they also jam up your workflows, delay reimbursements, and overwork your billing teams.

Still, most healthcare leaders only scratch the surface when it comes to tracking them. They’ll know the denial rate, maybe the total dollar amount denied, but not why it’s happening, where the denials are coming from, or how to prevent them upstream.

And when denials go unchecked, clinics and hospitals are often forced to write off revenue that should have been collected.

In this guide, we’ll break down the basics of claim denials, spotlight common causes, and show you how smarter tracking (and AI agents) can help you move from reactive clean-up to proactive prevention.

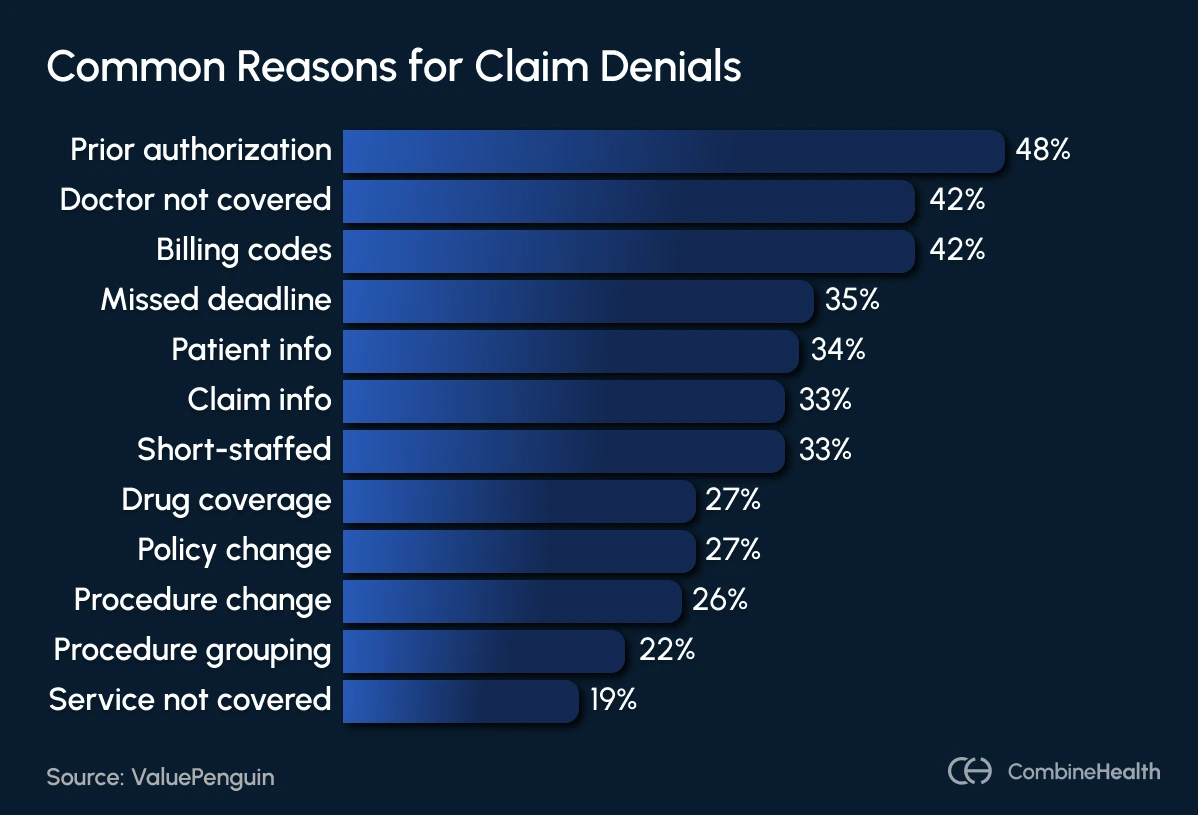

What Are the Common Reasons for Claim Denials?

Understanding why claims get denied is the first step to preventing them. While denials can stem from a long list of issues, most fall into a few predictable (and fixable) categories.

Let’s break down the most common culprits of denial:

- Registration or eligibility errors: These include simple mistakes in patient registration, like a misspelled name, outdated insurance ID, or incorrect plan details. They often lead to automatic rejection from payers.

- Lack of prior authorization: If a procedure requires pre-approval and it wasn’t obtained, the claim is often denied outright. This is a frequent issue for specialist referrals, imaging, and surgical procedures.

- Missing or incorrect claim data: Claims missing required information, like the date of service, provider details, diagnosis codes, or even patient demographics, can trigger denials.

- Coding errors: Using outdated or incorrect CPT, ICD-10, or HCPCS codes can lead to fast rejections. Coding mismatches, such as a diagnosis that doesn’t justify the procedure billed, are also red flags for payers.

- Insurance coverage issues: Sometimes, services get denied simply because they aren’t covered under the patient’s insurance plan—whether due to plan exclusions, expired coverage, or a lack of medical necessity.

- Missed filing deadline: Late claims are automatically denied, and often not appealable unless there's a valid exception.

How Do Payers Communicate Denial Reasons?

Payers use standardized denial codes, including CARCs (Claim Adjustment Reason Codes) and RARCs (Remittance Advice Remark Codes), to explain why a claim was denied.

Below is an example of an Explanation of Benefits (EOB) showing claims that were denied and the codes for denial reasons:

.webp)

At this stage, the denial analyst plays a critical role in identifying the root cause by interpreting the denial code.

But here’s the challenge: every payer uses its own set of rules and naming conventions for denial reasons. That means the analyst either needs to memorize each payer’s unique codes—or translate them into a standardized format like CARC to make sense of what went wrong.

CombineHealth’s Mark automatically generates CARC codes for all the denied cases, eliminating manual analysis.

The table below outlines the common denial CARC codes and the specific cases when they apply:

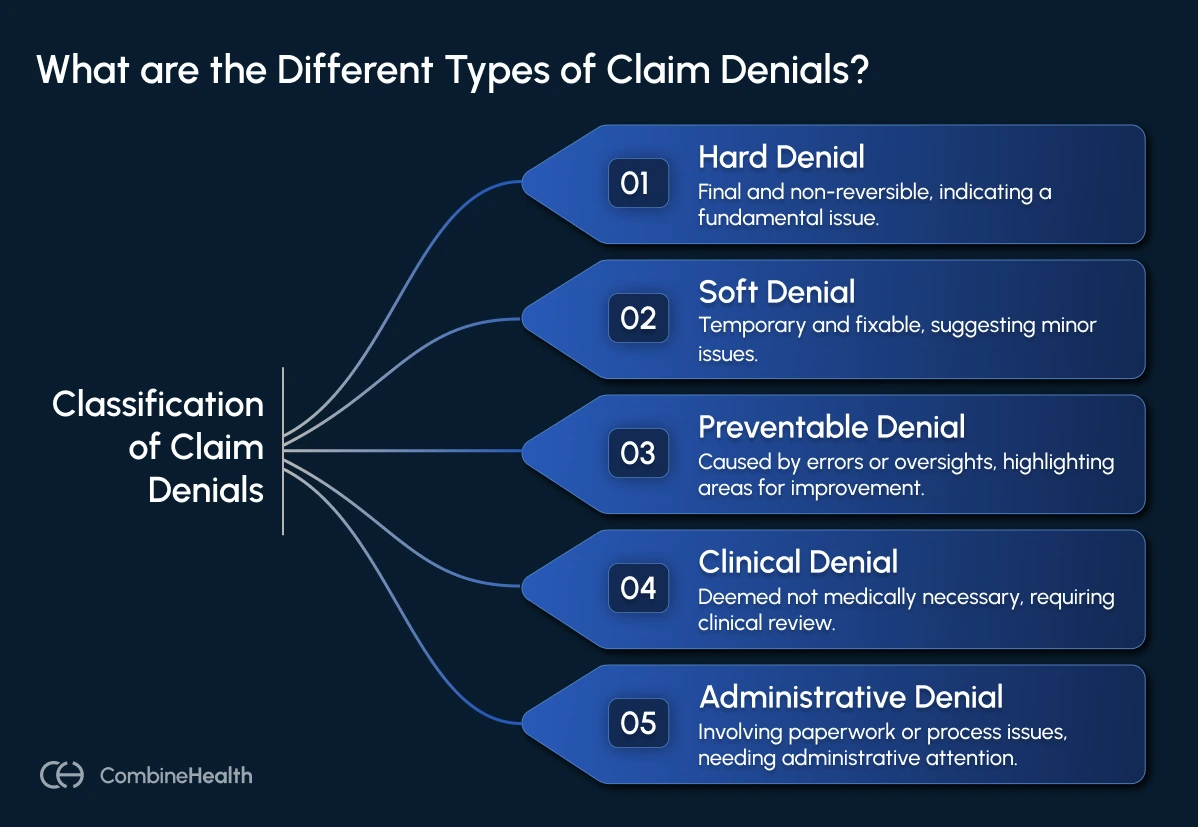

What Are the Different Types of Claim Denials?

Not all denials carry the same financial weight, and knowing the difference is key to protecting your margins.

Here are the different types of claim denials:

Hard Denial

Financial Impact: Increased administrative costs, and delayed (or lost) revenue

Plan of Action: Appeal (if eligible) or write-off, track denial reasons by payer, and identify training gaps

A hard denial is the billing world’s “dead end.”

It’s final, non-reversible, and typically results in lost or written-off revenue unless you can successfully appeal (which is rare).

Hard denials usually happen when a service isn’t covered under the patient’s plan or when a claim misses a critical deadline.

Example:

A plastic surgery clinic submits a claim for a cosmetic nose reshaping procedure, but the payer rejects it because cosmetic surgeries aren’t covered under the patient’s policy.

Soft Denial

Financial Impact: Increased administrative costs, delayed revenue, and high volume of small-dollar denials add up over time

Plan of Action: Identify the root cause, correct and resubmit, and fix documentation issues by automating validation

A soft denial is more like a “pause button”—the claim isn’t approved as is, but the problem can be fixed.

These denials often occur due to incomplete data, missing attachments, or coding errors. But once corrected, these claims can be resubmitted and paid.

Example:

A hospital’s claim for an outpatient procedure is denied because the billing team forgot to include a required modifier. Once the modifier is added and the claim is resubmitted, the payer processes the payment.

Preventable Denial

Financial Impact: Expensive rework, burns staff time, and payment delays

Plan of Action: Focus on streamlining CDI workflow, conducting eligibility verification, and training coding staff

A preventable denial is one that never should have happened in the first place.

These denials are caused by internal errors, such as incorrect coding, missing insurance verification, or bad data entry, all of which could have been avoided with better workflows.

Example:

A claim for a routine lab test gets denied because the patient’s insurance policy had expired, but the front desk team failed to check eligibility at the time of service. This could have been caught with a simple real-time eligibility check.

Clinical Denial

Financial Impact: Affects high-cost services; the appeals process is time-consuming and labor-intensive (physician reviews, medical records, peer-to-peer reviews)

Plan of Action: Appeal with strong clinical documentation, proactively review trends for high-risk services

Clinical denials happen when the payer believes the service wasn’t medically necessary or appropriate, based on the documentation submitted.

These are often complex and require medical evidence to appeal.

Example:

An insurance company denies an inpatient hospital stay, arguing that the patient could have been treated under observation status instead. To appeal, the hospital would need to submit detailed medical records and a physician’s note justifying the admission.

Administrative Denial

Financial Impact: Generally low per claim, cumulative cost can be high due to repeated rework

Plan of Action: Implement automated claim scrubbing tools, standardize claim formats, and ensure payer rules are up-to-date in billing software

Administrative denials are process-related. They occur when something is missing or incorrect in the claim paperwork, but they’re usually fixable once the issue is addressed.

Example:

A claim is denied because the provider’s National Provider Identifier (NPI) wasn’t listed, or because the claim was flagged as a duplicate submission. Correcting the NPI or clarifying the duplicate often resolves the denial quickly.

Claim Denial Rates by Insurance Company

Denial rates can vary dramatically depending on the payer. While one insurer might reject just 5% of claims, another could deny more than 30%, creating a heavier lift for your billing team.

To help you understand how claim volume and potential denials break down by payer, here’s a snapshot of claims denied across major insurers:

.webp)

How To Appeal an Insurance Claim Denial

Once a claim gets denied, it’s up to your team to correct or appeal the denial.

Traditionally, that would involve a tiresome manual process:

- Digging through EOBs

- Identifying the denial reason

- Pulling clinical records

- Correcting errors

- Writing a formal appeal letter

And all this, while juggling different systems and payer portals!

Also, this manual process can be quite expensive. Industry estimates suggest that manually appealing a single claim can cost up to $25 for physician practices and over $180 for hospitals.

No surprise then that 60% of denied claims are never appealed at all; they’re just written off.

.webp)

Problem With The Traditional Denial Management Approach

Many healthcare organizations track the numbers but stop short of solving the underlying problems. Here are a few common blind spots:

- Tracking the "what" but not the "why": Denial rate, total dollars denied, and volume trends are useful, but without breaking them down by denial reason, department, or payer, you’re flying blind.

- Relying solely on basic EHR or clearinghouse reports: Many standard reports only show the primary denial reason, miss duplicates, or require error-prone manual entry from paper EOBs.

- Overlooking underpayments and payment variance: Many organizations miss partial payments, contractual underpayments, or adjustments that don’t match payer contracts.

- Not closing the loop with front-line teams: If front-line teams aren’t told about their mistakes, the same denials will keep repeating.

- Ignoring denial patterns over time: If you’re not reviewing denial trends monthly, by code, service line, or payer, you’ll miss emerging issues.

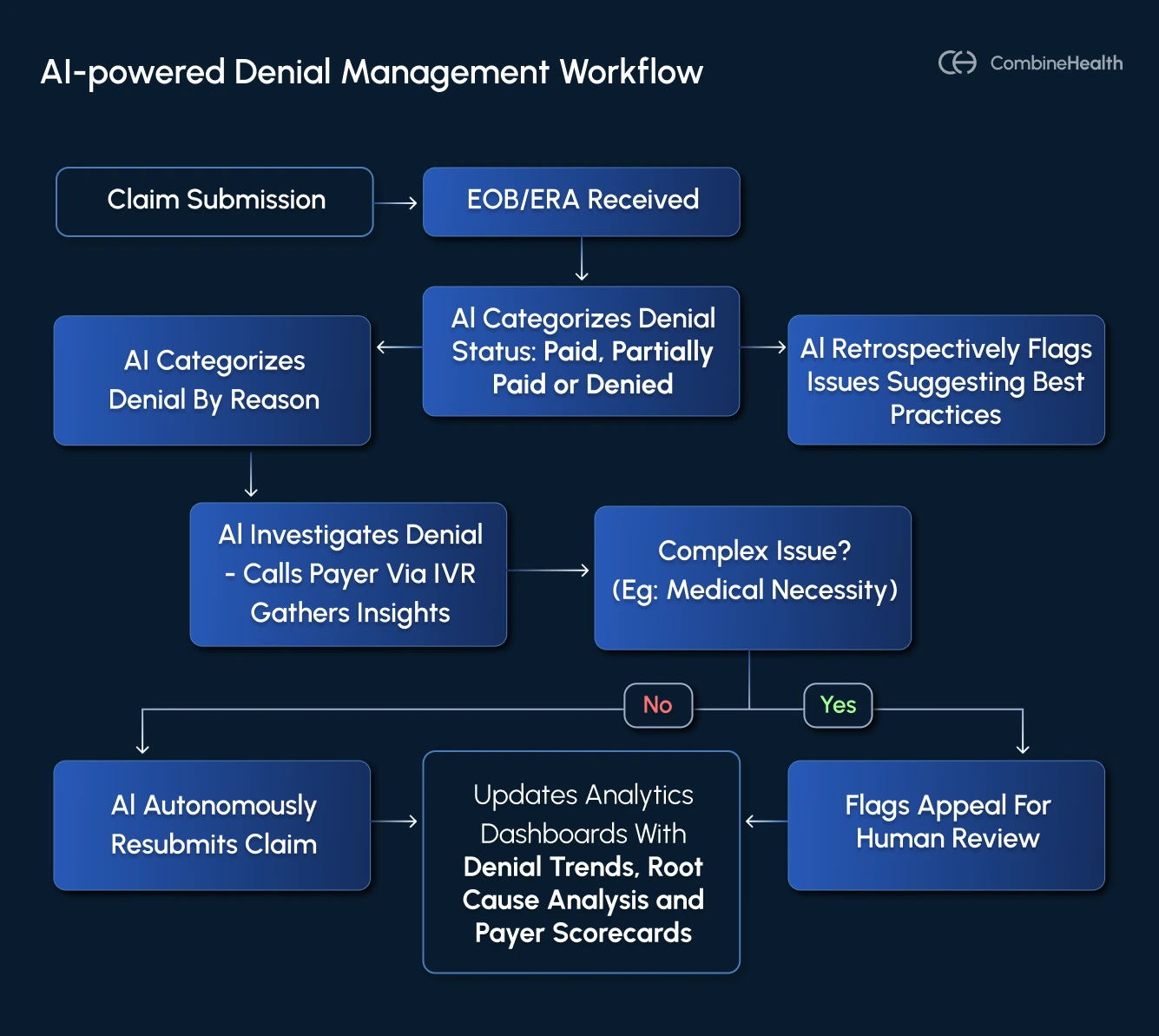

Rethinking Denial Management With AI

Manual denial management is slow, reactive, and prone to human error. And incorporating AI in your denial management process can help you fix that!

Instead of relying on after-the-fact cleanup, AI-enabled denial management helps revenue cycle teams detect, prioritize, and resolve denials faster (often before they require appeal).

Here’s what a truly intelligent denial strategy can look like with AI in place:

1. Automation of Denial Interpretation and Categorization

AI can instantly decode denial reasons, normalize them into standardized CARC/CAGC codes, and categorize them by type. This reduces ambiguity and gets your team to the resolution faster.

CombineHealth’s Amy (the medical coder) incorporates payer-specific rules when interpreting claim data and flags documentation gaps that could trigger clinical or coding denials downstream.

2. Surfacing Root Causes and Workflow Breakdowns

AI can trace denials back to where they actually originated, not just what the payer said. That means connecting the dots between denial reasons and upstream workflows, like a specific department, coder, or step in the billing process.

CombineHealth’s Taylor (the analytics agent) identifies systemic issues by analyzing both activity (e.g., how many claims submitted, how many calls made) and outcomes (e.g., denial rates, average time in A/R).

3. Prioritizing What Matters Most

AI helps you triage denials based on dollar value, age, payer policies, and likelihood of recovery—so your team works smarter, not just harder.

CombineHealth’s Adam (A/R follow-up agent) incorporates these rules directly into his workflows, prioritizing follow-ups on high-value claims and organizing worklists by payer, urgency, and appeal deadline.

But beyond claim-level triage, AI can help you zoom out and identify which payers consistently cause the most friction or delay. Most hospitals don’t maintain payer scorecards, but doing so can radically simplify strategic decisions, like:

- Which payers have the highest denial rates?

- Which ones delay payments or reject clean claims?

- Where are appeals most successful?

4. Automating Follow-Ups and Documentation

Chasing denials is time-consuming and often requires dealing with IVRs, payer chats, or phone reps. AI can take on this grunt work, navigating payer systems like a human rep, recording call outcomes, and documenting next steps to keep your team in the loop.

CombineHealth’s Adam makes these calls, chats with payers, records voicemails, and produces call summaries with actionable insights for resolution.

5. Turning Appeals into a Last Line of Defense

A smarter AI-powered denial strategy focuses on minimizing how often you need them through:

- Better claim scrubbing

- Pre-bill audits

- Clinical documentation integrity (CDI)

- Real-time eligibility checks

And while AI helps reduce the need for appeals, it also ensures that when you do have to file one, you’re not starting from scratch. Appeal letters can be generated with the correct payer language, denial reasoning, supporting documentation, and coding rationale automatically.

CombineHealth’s Rachel (appeals assistant) handles this step, pulling in insights from Amy (coding) and Penny (policy) to generate accurate, payer-specific appeals before the filing deadline.

When all of this is in place, denial management becomes less about firefighting and more about continuous process improvement.

Here are the different metrics you can track using an AI denial management system:

Turn Denials Insights Into Revenue

Claim denials are more than just billing headaches. They’re signals that something in your revenue cycle needs attention.

By understanding the root causes and equipping your team with the right tools, you can stop chasing denials and start preventing them from happening in the first place.

That’s where CombineHealth’s Adam (AI Agent for Denial Management) steps in.

Other than flagging denied claims, they also:

- Parse ERAs/EOBs at scale

- Follow up with payers directly

- Draft appeal strategies or resubmit claims

- Route complex cases for human review

- Analyze payer denial patterns to fight payer’s AI

- Learn from your workflows

And as a result, you get fewer write-offs, faster reimbursements, happier staff, stronger margins, and most importantly, satisfied patients.

Curious to learn more about our AI agents? Book a demo!

FAQs

Is a claim denial the same as a claim rejection?

No, they’re not the same.

A claim rejection means the claim was never accepted into the payer’s system due to formatting or submission errors (like a missing NPI or invalid patient ID).

A claim denial means the claim was accepted and processed, but payment was refused.

How do I resolve a denied claim?

Start by reviewing the denial code and reason on the EOB or ERA. Identify the root cause and then correct the issue (e.g., update codes, add documentation) and resubmit or appeal the claim as needed.

Which is an example of a denied claim?

An example of a denied claim is when a payer refuses payment for a level 4 office visit (99214) because the documentation didn’t support the medical necessity for that level of service.

What is the most common reason for claim rejection?

The most common reason for claim rejection is missing or incorrect patient information, like an invalid member ID, wrong date of birth, or misspelled name.

Can you correct a rejected claim?

Yes, rejected claims can be corrected. Fix the errors (e.g., invalid ID or missing info) and resubmit the claim. Since rejected claims are not processed, they don’t count as filed.

How to reduce claim denials?

To reduce claim denials, verify patient eligibility upfront, ensure accurate coding and documentation, submit claims on time, and review payer guidelines regularly.

Related Posts

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Subscribe to newsletter - The RCM Pulse

Trusted by 200+ experts. Subscribe for curated AI and RCM insights delivered to your inbox

Let’s work together and help you get paid

Book a call with our experts and we'll show you exactly how our AI works and what ROI you can expect in your revenue cycle.

Email: info@combinehealth.ai